NIKE REVOLUTION MEN’S SNEAKERS FOR SALE, WITH GREAT DEALS THAT YOU WILL LOVE TO GET. IF YOU LOVE ANY OF THESE COLOUR WALKING SHOES? JUST CLICK ON THE SAME AND MAKE YOUR PURCHASE. Enjoy your favorite activities in your favorite athletic sneaker with the men’s Revolution 5 from Nike. With a breathable mesh and synthetic […]

New Balance Women’s DRFT Shoes For Sale, With Great Deals That You Will Like. If you are interested in same? Just click on the same and make your purchase. Working out, hanging out or heading out on an errand, the DRFT is your most versatile go-to women’s sneaker. It’s made with breathable engineered mesh and […]

Sexy Women Strappy Bodycon Dress, Ladies Cocktail Evening Party Long Maxi Dresses for sale, with great deals. IF YOU ARE INTERESTED IN SAME? JUST CLICK ON THE SAME AND MAKE YOUR PURCHASE. Product Description Product Features: Dress Length: Ankle-Length Sleeve Length: Sleeveless Sleeve Type: Strappy Sleeve Neckline: V-Neck Material: Polyester Fabric Type: Woven Pattern: Solid […]

IF YOU ARE INTERESTED IN THIS Reebok Fusion Flex weave Men’s Shoe? WE DO HAVE A LOT MORE, IN DIFFERENT COLOURS, WITH GREAT DEALS, THAT YOU WILL LOVE TO GET. Product Description:Reebok Fusion Flexweave Mens Shoes Kick your workout into high gear with the help of our fusion flex we a ve shoe. The flex […]

DREAM PAIRS Women’s Ankle Strap Chunky High Heel Sandals Open Toe Sandals Shoes. Great Deals On Same. IF YOU ARE INTERESTED IN THESE LOVELY PAIRS OF SHOES? JUST CLICK ON THE SAME AND MAKE YOUR PURCHASE. DREAM PAIRS Women’s Ankle Strap Chunky High Heel Sandals Open Toe Sandals Shoes Imported Rubber sole Open Toe Chunky […]

IF YOU ARE INTERESTED IN THIS PUMA Men’s Pacer Future Sneakers Shoes? Just click on same and make your purchase, great deals that you will love to get. Inspired by street running, Pacer Future reinvents the mold of everyday comfortable shoes. The sleek, streamlined upper pairs with a Soft Foam+ sock liner for instant step-in […]

Women Ripped High Waist Denim Jeans Plain Stretch Skinny Pencil Pants Trousers. Great deals on same. If you are interested? Just click on the same and make your purchase. Support 30 days Return PolicyAnswer Within 24 hoursFree Shipping Description100% Brand New, High Quality Material: Cotton Blend THE NEW PANTS HAVE NO BUTTON HOLES! Size:S M L XL Color:White Black Package […]

New Men’s Brown Tan Ferro Aldo Checkered Plaid Shoes Wing Tip Brogue, With Great Deals, that you will love to get. Item description Ferro Aldo shoes are a high quality pair of Oxford’s. These shoes can be worn at weddings, proms, or any black-tie occasion to match your tux and make you look great!”. I […]

GREAT DEALS ON Bruno Marc Men’s Genuine Leather Shoes, Casual Lace Up Business Dress Oxford Shoes. IF YOU ARE INTERESTED IN SAME? JUST CLICK THE SAME AND MAKE YOUR PURCHASE. Bruno Marc Mens Genuine Leather Shoes Casual Lace Up Business Dress Oxford Shoes Description: Ethylene Vinyl Acetate sole Heel measures approximately 1 inch 100% premium […]

Men’s Luxurious Wool Feel SUIT Glen Plaid 3 Piece Vest 2 Button Classic Fit. Great suits to have, with great deals that you will love. Item specifics Condition: New with tags: A brand-new, unused, and unworn item (including handmade items) in the original … Read more about the condition Waist Size: 32-56Jacket/Coat Length: Mid-Length Jacket […]

SWEATPANTS MENS and WOMENS FLEECE Pants Cargo Pants Joggers XL to 6XL. We have them in various sizes, with great deals. Item specifics Condition:New with tags: A brand-new, unused, and unworn item (including handmade items) in the original packaging (such as the original box or bag) and/or with the original tags attached. Waist Size: Expandable […]

IF YOU ARE INTERESTED IN THESE LOVELY, LATEST TYPES OF WEDDING DRESSES? JUST CLICK ON SAME AND MAKE YOUR PURCHASE, WE HAVE VARIOUS TYPES WITH GREAT DEALS, THAT YOU WILL LOVE HAVE. Item specifics Condition:New without tags: A brand-new, unused, and unworn item (including handmade items) that is not in original packaging or may be […]

For Apple Watch Series SE 7 6 5 4 38 42 40 44mm Milanese Loop iWatch Band Strap. Apple Watch Bands For Women And For Men, with great deals that you will love. Feature:√ [ Fit Wrist Size ]: Fits 4.1″-7″ (38mm/40mm/41mm) / 4.3″-7.3″ (42mm/44mm/45mm) wrists.√ [ Breathable & Comfortable ]: The quick release bands made of premium mesh woven stainless steel […]

Pet Dog Cat Bed Donut Long Plush Fluffy Soft Warm Cushion Mat Sleeping Kennel. IF YOU ARE INTERESTED IN ONE OF THESE PET BED? JUST CLICK ON SAME, OR ON READ MORE AND MAKE YOUR PURCHASE. Features:Very cute lovely design for your pet.Non toxic, environmental friendly,mildew proof and moth proof.Keeps your dogs a good sleeping […]

NEW BALANCE MEN’S MT410 V7 4E WIDTH ALL TERRAIN TRAIL RUNNING SHOES. lovely shoes to have. If you love same? Just click on same, or on read more and make your purchase, great deals. Item specifics Condition: New with box: A brand-new, unused, and unworn item (including handmade items) in the original packaging (such as […]

New Women Stylish Hight Waist Stripes Print Skinny Bell-bottom Denim Pants Jeans. If you love same? Just click on same, or on read more and make your purchase, great deals. Item specifics Condition: New with tags: A brand-new, unused, and unworn item (including handmade items) in the original packaging (such as the original box or […]

Men’s Red Label Premium Faded Denim Cotton Jean Button Up Slim Fit Jacket. However we have them in different sizes, with great deals. If you are Interested in same? Just click on the shirts, or on read more and make your purchase. This men’s red label quality blue faded denim jacket features button up closure, […]

WEDDING DRESSES IN VARIOUS COLOURS. IF YOU ARE INTERESTED IN SAME? JUST CLICK ON THE DRESSES AND MAKE YOUR PURCHASE, WE HAVE MANY DRESSES WITH GREAT DEALS, THAT YOU WILL LOVE. Black V Neck Wedding Dresses Long Sleeves Lace Applique Bridal Gowns. Designer/Brand: Unbranded Country/Region of Manufacture: China Dress Length: Full-Length Style: Ball Gown Sleeve […]

Long Chiffon Wedding Bridesmaid Dresses, Formal Party Gown, Ball Prom Dresses

click photo for more information

Long Chiffon Wedding Bridesmaid Dresses, Formal Party Gown, Ball Prom Dresses Item specifics Condition: New without tags: A brand-new, unused, and unworn item (including handmade items) that is not in original packaging or may be missing original packaging materials (such as the original box or bag). The original tags may not be attached. Size: Stock […]

Men’s Three Piece Two Button Suit, Men’s Business Casual Suit Tuxedo

click photo for more information

Three-piece Two Button Men’s Business Casual Suit Tuxedos Wedding Groom Party US. IF YOU LOVE SAME? JUST CLICK ON IT AND MAKE YOUR PURCHASE, WE HAVE A LOT OF DIFFERENT SUITS WITH GREAT DEALS. Item specifics Condition: New with tags: A brand-new, unused, and unworn item (including handmade items) in the original packaging (such as […]

HP Pavilion x360 14″ 2-in-1 TOUCHSCREEN Intel i5-1035G1 8GB RAM 256GB SSD Win 10. PLEASE NOTE, THAT WE HAVE MANY DIFFERENT TYPES OF LAPTOPS, WITH GREAT DEALS. IF YOU ARE INTERESTED IN THESE LAPTOPS? JUST CLICK ON SAME AND MAKE YOUR PURCHASE. Model: HP Pavilion x360 Maximum Resolution:1920 x 1080 Operating System: Windows 10Graphics Processing […]

Women’s Air Cushion Slip-On Sport Shoes, Breathable Mesh Walking Running Sneakers

click photo for more information

Item specifics Women’s Air Cushion Slip-On Sport Shoes, Breathable Mesh Walking Running Sneakers. IF YOU LOVE SAME? JUST CLICK ON THE SHOES OR ON READ MORE AND MAKE YOUR PURCHASE, GREAT DEALS. Condition: New without box: A brand-new, unused, and unworn item (including handmade items) that is not in original packaging or may be missing […]

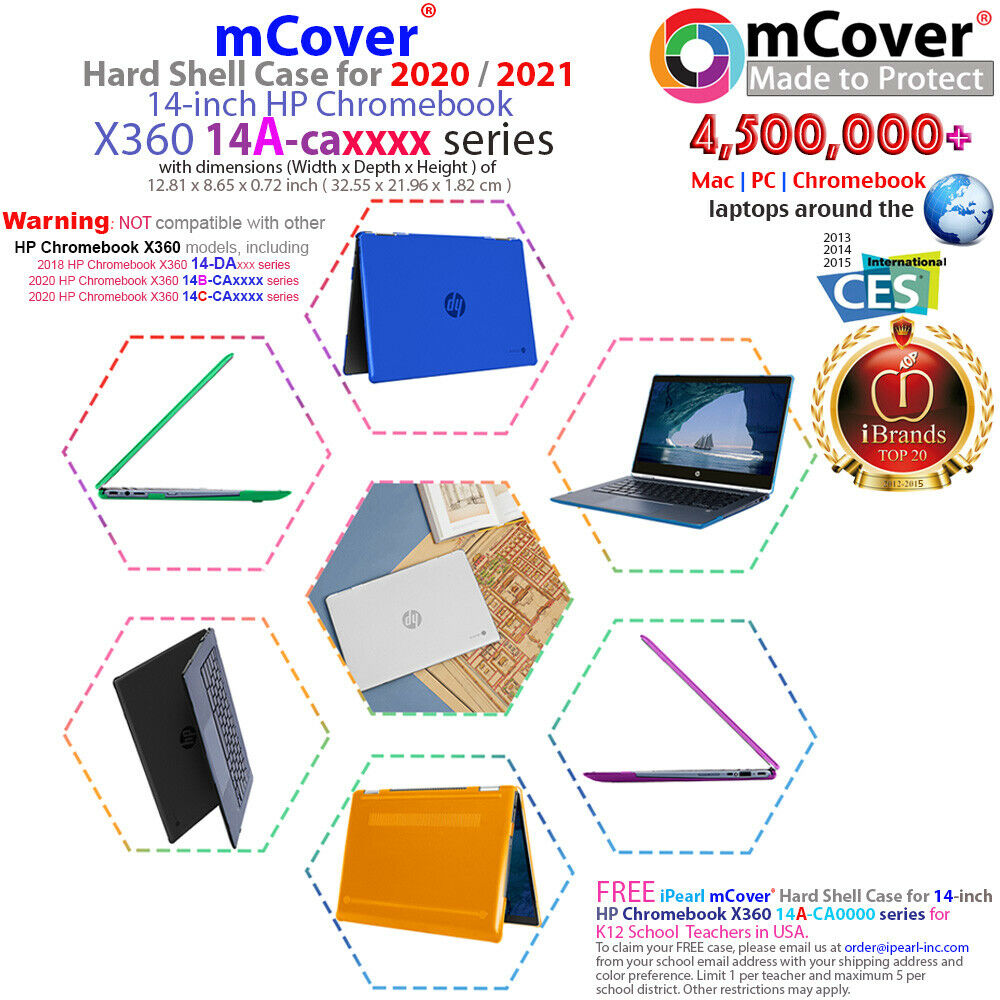

HARD COVER CASE FOR ALL VARIOUS TYPE OF LAPTOP COMPUTERS. IF YOU LOVE SAME, JUST CLICK ON SAME OR ON THE READ MORE BUTTON AND COME IN WE ARE OPEN. FAQ: 1) Will this hard shell case fit my HP Chromebook X360 14-inch laptop?Yes, it will ONLY fit the late-2020 14-inch HP Chromebook X360 14A-CAxxxx series ( like HP Chromebook X360 14A-CA0090wm […]

AFRO HUMAN HAIR WIG TOUPEE, FOR MEN. IF YOU ARE INTERESTED IN SAME? JUST CLICK ON IT OR ON READ MORE AND MAKE YOUR PURCHASE. Jorya Hair aims to provide the best hair replacement system and satisfy all customers’ needs. We truly care for our clients. We aim to build and maintain meaningful relationships with […]

IF YOU ARE INTERESTED IN THIS HAIR WIG? JUST CLICK ON SAME OR ON READ MORE AND MAKE YOUR PURCHASE. WE DO HAVE A LOT OF DIFFERENT TYPES, WITH GREAT DEALS. Item specifics Condition: New without tags: A brand-new, unused, and unworn item (including handmade items) that is not in original packaging or may be […]

INTERESTED IN THESE WIRELESS DOORBELL CAMERAS, JUST CLICK ON SAME OR READ MORE AND MAKE YOUR PURCHASE. WE HAVE A LOT MORE WITH GREAT DEALS. Product Features:1. The video door intercom bell is support two way audio, When somebody push the doorbell or PIR detected alarm, your mobile app will receive an alarm video call […]

INTERESTED IN THESE SECURITY CAMERAS? JUST CLICK ON SAME OR READ MORE AND MAKE YOUR PURCHASE. WE HAVE VARIOUS TYPES WITH GREAT DEALS. Plug & Play and Easy Setup】The wireless cameras are paired with the NVR system at manufacturing site. Just power on and serve yourself with 24/7 surveillance. Perfect for villa, home, office, shop, […]

Features: INTERESTED IN THESE PET FOOD DISPENSER? JUST CLICK ON SAME AND MAKE YOUR PURCHASE? WE DO HAVE VARIOUS TYPES WITH GREAT DEALS. Large Capacity: 3.8L large capacity allows you to raise your pet without worries. Cats and small dogs can drink for 3-4 days, medium and large dogs can drink for 1-2 days. The water […]

Under Desk Stationary Exercise Bike – Portable Arm Leg Foot Pedal Exerciser. IF YOU ARE INTERESTED IN THIS EXERCISE EQUIPMENT? JUST CLICK ON SAME AND MAKE YOUR PURCHSE. WE HAVE MANY OTHER DIFFERENT TYPES WITH GREAT DEALS. WEIGHTED FLYWHEEL: Featuring a weighted flywheel this pedal exerciser provides a more fluid cycling motion. Less friction when […]

Love this bike? Just click on same and make your purchase. Great deals and we do have a lot of different make exercise bikes for sale. 【Heavy Duty Steel Frame & 40 lbs Flywheel 】Built with heavy-duty triangle frame ,40 lbs steel fly wheel ,thick tube. Max bearing capacity of armrest is 264 lbs and […]

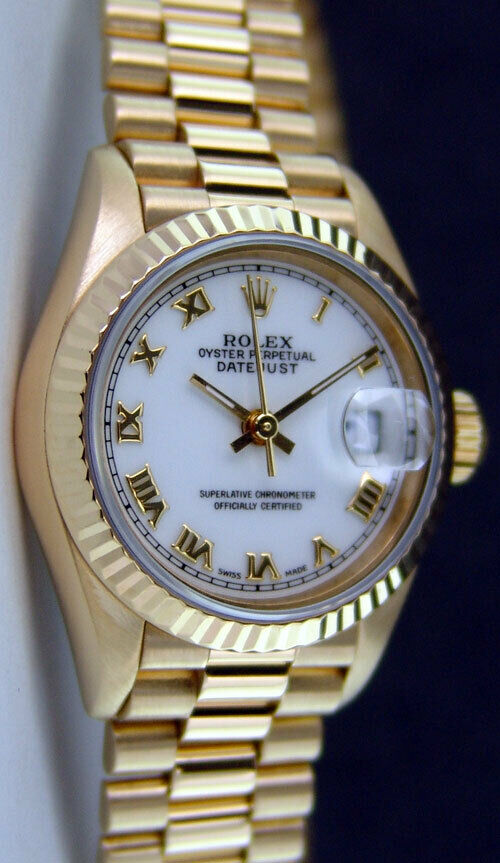

IF YOU LOVE THIS WATCH? JUST CLICK ON SAME AND MAKE YOUR PURCHASE? WE HAVE VARIOUS TYPES WITH GREAT DEALS. Apple Watch Series 7 45mm GPS Midnight Case with Midnight Sport Band MKN53LL/A FREE 1 YEAR WARRANTY, 2 DAY SHIP, 30 DAY FREE RETURNS Warranty For functionality, this item comes with a one year warranty […]

Love these radios? Just click on same and make your purchase, we have various types, with great deals. Emergency Radio Solar Hand Crank AM/FM NOAA Weather Radio for Household and Outdoor with LED Flashlight, Reading Lamp, SOS Alarm and 2000mAh Power Bank for iPhone/Smartphone About this item 💪🏼【Large Capacity Emergency Radio】: An emergency flashlight broadcast […]

LOOKING FOR DETTOL TO PURCHASE? JUST CLICK ON SAME AND MAKE YOUR PURCHASE. SHIPS FROM USA – YOU DO NOT HAVE TO WAIT FOR WEEKS ON SAME. PACKAGE INCLUDES : DETTOL ANTISEPTIC LIQUID 750 ML + 250 ML ……Fast Shipping…… Product Details Expiration Date: September 2024 Dettol Liquid Antiseptic Disinfectant is a proven effective concentrated […]

2021 Newest 3600 Miles Digital TV Antenna Indoor 4K 1080P HDTV Amplified Signal If you are not 100% satisfied with our product, please contact us. You can get a full refund or a replacement. Your TV must be a digital TV to use this digital antenna. If it is an analog TV, you will need […]

Save Real Bargains. If you are interested in these awesome musical instruments? Just click on same and make your purchase. Please note that we have a lot of various types, with great deals, that you will love to get.

SAVE REAL BARGAINS. GREAT DEALS ON VARIOUS HANDBAGS, THAT YOU WILL LOVE TO HAVE. IF YOU ARE INTERESTED IN SAME? JUST CLICK ON THE BAGS ABOVE AND MAKE YOUR PURCHASE. Features: Material: Saffiano Leather Exterior or PVC Exterior With Leather Trim Double Leather and Chain Straps with 10″ drop Zipper closure Michael Kors signature name […]

INTERESTED IN THIS GUITAR? JUST CLICK ON SAME AND MAKE YOUR PURCHASE. Full Size Blue Electric Guitar with Amp, Case and Accessories Pack Beginner. Product Identifiers Brand Segawe Model OFW-Y01-1206A-2eBay Product ID (ePID) 17021540528 Product Key Features SizeFull-Size Body Color Blue Number of Frets 22 Handedness Right-Handed Neck Material Maple Fret board Material Hardwood Body […]

GREAT DEALS. IF YOU ARE INTERESTED IN THESE CARGO SHORTS, JUST CLICK ON SAME AND MAKE YOUR PURCHASE. Cotton Cargo Shorts w/ Belt Regular Fit Design Zip Fly Button Closure Tonal D-Ring Belt Belt Loops Button Flap Cargo Pockets at Sides Flap Pockets at Back Drawstrings at Hem Distressed Washed Vintage Look Imported Material: 100% […]

IF YOU ARE INTERESTED IN THESE LOVELY LOOKING SHOES? JUST CLICK ON SAME AND MAKE YOUR PURCHASE. DREAM PAIRS Women’s Low Block Heel Ankle Strap Open Toe Party Dress Pump Shoes Rubber sole Heel measures approximately 3 inches” Platform measures approximately 0.15″ (approx) Buckle at ankle closure. Heel height: 3″ (approx) Platform height: 0.15″ (approx) […]

Men’s Dressing Shoes, Breathable Casual Shoes, Comfortable Business shoes

click photo for more information

IF YOU LOVE THIS SHOES? JUST CLICK ON SAME AND MAKE YOUR PURCHASE. Mens Dress Shoes Breathable Casual Shoes Comfort Business Shoes Size US 6.5-13 Synthetic sole Scaled synthetic upper Padded tongue and collar. Removable and soft foam footbed Lace-up construction for a secure fit Flexible TPR outsole, Heel measures approximately 1 inch. Mens Dress […]

IF YOU ARE INTERESTED IN THIS DOG BED, JUST CLICK ON SAME ON MAKE YOUR PURCHASE. WE DO HAVE BEDS FOR LARGE AND SMALL PETS, WITH GREAT DEALS. Condition: New: A brand-new, unused, unopened, undamaged item (including handmade items). See the seller’s listing for full details. Brand: EUCHIRUS Type: Nesting Bed Features: Foldable, Machine Washable, […]

Item specifics IF YOU LOVE THIS PHONE, JUST CLICK ON SAME AND MAKE YOUR PURCHASE. Condition: New: A brand-new, unused, unopened, undamaged item in its original packaging (where packaging is … Read more about the condition Camera Resolution:108.0 MP Model: Samsung Galaxy S21 Ultra 5G Operating System: Android Contract: Without Contract Custom Bundle: No Connectivity: 3G, […]

Fitting : True to sizeProduct Detail : Product Detail : These trendy sandals feature a threaded shark tooth outsole, espadrille jute rope wrap, Flatform platform, adjustable ankle straps, open toe sandal, warn-out vintage fabric, metal studded detail, and low faux wooden wedge.Box : Shoes will be shipped in either original box or replacement box These […]

Product Description The Cuisinart AirFryer Toaster Oven is now available in a new, space-saving design! Cuisinart TOA-28 AirFryer Toaster Oven is big enough to airfry up to 2.5 pounds of food, toast 4 slices of bread or bagel halves, and bake up to a 3-pound chicken. With all the features of Cuisinart full-size models, including […]

Product Description: u 【PERFECTLY DESIGNED TRICYCLE】- This trike is designed with 24-inch front fat tire 20-inch rear fat tire and is suitable for riders with a height of 4’11”-5’10”. Sand road, dirt road and snowy road, it rideable on virtually any terrain, giving you the capability to ride year-round. The tricycle is equipped with 7-speed adjustment, shock-absorbing seats and handlebar height adjustment functions. […]

Product Description: u 【PERFECTLY DESIGNED TRICYCLE】- This trike is designed with 24-inch wheels and is suitable for riders with a height of 4’11”-5’10”. The tricycle is equipped with 7-speed adjustment, shock-absorbing seats and handlebar height adjustment functions. u 【LARGE-CAPACITY SHOPPING BASKET】- This tricycle has a large rear shopping basket, which can be conveniently loaded with supplies and is also […]

Description:100% Brand new and high quality. Features: You will be amazed by the quality. Wearing it, it can bring you more confidence, and more charm! It is both natural looking and soft touch. You can wear it to parties as well as for daily use. The size is adjustable, and no pins or tape should […]

Features: Great deals on garage fans. Deformable: Can freely adjust the deformation Angle, suitable for different occasions Before the product is installed, disconnect the power supply, then rotate the embedded, and ensure that it will not fall, then turn on the power. LED Garage Lights can be installed with ceiling and hanging wire, suitable for […]

A lovely Long Sleeves High Neck Trumpet Sequins Evening Dress. Sale Price $129.99

If you love this Backless Floor Length Sleeveless Pullover Women’s Maxi Dress. Sale Price $31.11

Great Looking Zipper Back Long Sleeve Black Sheath Dress. Sale Price $27.73

Great looking V Neck Front Slit Belted Sequin Ladies Dress.

Great looking Round Neck Sleeveless Print Pullover Women’s Maxi Dress . Please share among your friends. Sale Price $38.20

If you love his great looking Smart Watch Phone – 1 IMEI, Pedometer, Calls, SMS, Social Media Notifications, Bluetooth , just click on the link and make your purchase?